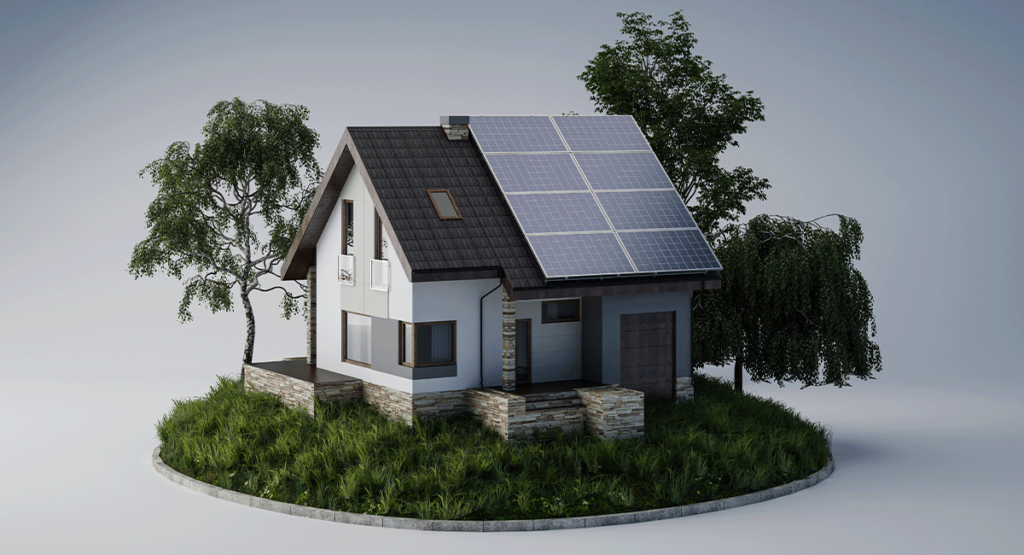

So what is the current state of solar, and is it still a worth while investment? The short answer is yes, residential solar is still a good investment. To explain why, we’ll summarize the broad national trends and then focus on our state of Virginia. Finally, we’ll focus on you, the individual homeowner, and discuss the solar investment in detail.

Solar is expensive; there’s no way around that, but it is a long-term investment. So, we will treat it as such. We’ll discuss how to finance it, the payback period, and the return on investment (ROI).

The Residential Solar Market Set a National Quarterly Record.

Residential solar is growing at a record pace! That’s great for us and the planet.

The national solar industry is steadily growing. 2022 saw a slight contraction. Supply chain issues and regulatory complications caused the solar industry to shrink slightly. But we’ve bounced back! The solar industry is growing at a record pace.

According to the Solar Energy Industries Association’s (SEIA) Solar Market Insight Report for 2023 Q3, the solar industry is expected to triple in the next five years. That’s more clean energy for our great nation thanks to long-term sustained growth.

However, Not All Industries Are Experiencing The Same Growth.

Commercial solar installations have declined quarter-over-quarter. Those are solar projects for commercial businesses such as university campuses or corporate offices. We’re currently seeing stagnation in this market. Commercial installations are more complicated and require more clearance than residential installations.

If you are a business owner, that should not deter you. As you’ll see, solar is a worthy investment. Not only will solar supplement your energy needs and increase your property value, but it will also foster a positive brand image. Show your clients that you care about your community. If you are concerned about the complexities, that’s what we’re here for. We know solar can be complicated, but it is worth it! We’re more than installers, we’re partners to help you every step of the way.

Community Solar is Experiencing Growing Pains.

Community solar projects are large-scale solar projects that supplement the energy consumption of an entire community. Sharing solar is great for renters, apartment complexes, low-income communities, and dense urban areas.

This market is facing stagnation and some declines for a variety of reasons. Market saturation, interconnection delays, pushback from utility companies, and slow government processes are just a few problems.

The experts at SEIA predict community solar will gradually grow in the next five years, thanks partly to new government funding.

What is Virginia Doing for Solar Energy?

Virginia is great for solar. You might think our extreme four seasons discourage sunlight collection. However, we receive more than enough sun to make solar practical.

Here in Virginia, solar costs around $3.00 per watt installed— give or take 20¢. So, a 10 KW solar system will produce 10 KW of power for every hour of peak sunlight and cost around $30,000. Virginia receives 4-4.5 peak sunlight hours a day. Of course, it changes with the seasons, but you can expect to produce around 40-45 KW a day. This is just an example to demonstrate your potential. We go into more detail about the costs here.

Let’s Talk Policy

Virginia implemented the Virginia Clean Economy Act to decarbonize the state’s grid by 2050. It aims for a diverse portfolio of different renewable energies. Solar is just one piece of the pie, but one Virginia policy seeks to facilitate.

Net metering is one such popular program that we go into detail here. Virginia’s Solar Renewable Energy Credits (SREC) is another program we’re proud to help residents take advantage of.

Let’s delve into the more nuanced policies.

Solar Increases Your Property’s Value, But Virginia Eases The Property Tax Burden.

One way Virginia encourages solar installations is through their property tax exemptions. Say you install a $30,000 solar system on a $350,000 house. Your property value increases to $380,000. However, you will receive a tax exemption of 80% of the solar system value. So, your home will be taxed for $356,000 (350,000 + (30,000 x 0.2). The average state property tax rate is 0.75%. Your property taxes would be $2,670 ($356,000 x 0.0075).

Virginia’s property tax exemption starts the year after installation. For the first five years, the exemption equals 80% of the solar system value. After that, the tax exemption drops to 70% for the next five years. Afterward (11 years after the original installation), the tax exemption is 60%. It stays at 60% for as long as the solar panels are used.

Check With Your Homeowner’s Association (HOA) Before Installing Solar.

Chapter 7 of Title 67 in the Code of Virginia prevents HOAs from prohibiting individual residential solar panels. However, they can still restrict some aspects of your solar installation, such as the size or number of panels. Even those restrictions have to be within reason.

HOAs can only stop your solar installation if their recorded declaration (a legal document setting out its rules at its founding) explicitly prohibits all solar installations. So, they can’t prevent you as an individual homeowner from going solar. But they can prevent everyone in your neighborhood from going solar if they said so at their founding.

In short, check with your HOA. They might request a copy of the design plans, which we will be more than happy to provide.

What About You? Is Solar a Good Investment For You?

Solar is expensive; there is no way around that. Utility companies fight against community solar projects. However, they are more likely to accept and, in some cases, support residential projects. Commercial projects might be out of your control, but your home is yours to improve as you please.

Solar is an Investment, So Let’s Discuss The Payback Period and The Return On Investment.

Of course, this will depend on your individual system. We design individualized systems. A system personalized to your needs will be the most efficient system. We discuss how many solar panels you need here.

The payback period is calculated by dividing the initial investment by the annual savings.

(Initial investment) / (annual savings) = payback period.

Let’s see that with numbers. Remember, this is a rough estimate just to give you an idea. Let’s say you purchase a $30,000 solar system outright, which means you are eligible for the 30% Federal Tax Credit. So, your initial investment is $21,000 ($30,000 – ($30,000 x 0.3)).

Now, for annual savings, let’s say you used to pay $200 monthly for electricity. Let’s say your solar system supplements 90% of your energy needs, reducing your monthly bill to $20. Annually, you are saving $2,160 (2,400 – 240).

$21,000 / $2,160 = 9.7 years.

So your $30,000 10 KW solar system will pay for itself in around 10 years.

We calculate the return on investment (ROI) by subtracting the payback period from the industry standard warranty. Then, we multiply that difference by the annual savings. Does this take you back to grade school math?

The industry standard warranty for solar panels is 25 years. That means after 25 years, your solar system will still operate at 80% of its original efficiency. However, many solar systems last longer than their warranty. That is what makes them such a long-term investment. Let’s round the payback period up to 10 years.

(25 – 10) x $2,160 = $32,400

After 25 years of use, you will save $32,400 in energy. Remember, this is a rough estimate with simplified math. It does not consider Virginia’s annual 2% price increase in electricity. It also assumes you pay for your system outright.

How Will You Pay For Your System?

Paying for solar in cash is ideal since it offers the most savings. But most of us don’t have $30,000 to drop on a home improvement project. Luckily, there are financing options.

A Solar Loan is the next best thing. It’s like any other loan but specifically designed for solar projects. They usually require zero or very little money down. The payment plan will involve monthly payments with interest. However, they normally aim to be lower than your current monthly electricity bill. The idea is to provide savings while you pay for your system. Because you own it, you will have to pay for maintenance and servicing. However, you are eligible for all those incentive programs.

We generally do not recommend Solar Leases or Power Purchase Agreements (PPAs) because you won’t own your system. Basically, a third party owns and installs the system, and you pay for the electricity it produces. You are trading in one utility company for another. Monthly rates vary. Some PPAs lock you into a set rate or have a rate schedule that rises annually. Because you don’t own it, you are not responsible for the maintenance. However, you cannot take advantage of the incentives. Selling your home also becomes more complicated because you must transfer ownership or pay a hefty termination fee.

You could fund your solar project with a Cash-Out Refinance or HELOC. We are not a mortgage company; this is just an overview of the options. If you are curious, then you should talk with your mortgage lender.

Cash-out refinancing is a refinance option that basically extracts the equity you’ve built into your home. Most people do this type of refinancing for home improvement projects.

HELOC stands for home equity line of credit. You’re essentially using the equity of your home as a low-interest credit card.

Let’s Get Started!

Ready to take your energy needs into your own hands? Get your solar project rolling by requesting a quote. If you have any questions, concerns, or curiosities, please reach out to us at (757) 447-6527.