Can’t decide whether solar is right for you? A cost-benefit analysis will clarify the choice! So, let’s examine solar’s costs and financial benefits. We’ll explore payback periods and potential return on investments (ROI). By the end of this blog, we’ll answer:

- How solar is an investment.

- How to calculate the size of your solar system.

- How many panels your solar system will need.

- What peak sunlight hours are and why they are important to residential solar

- How to calculate the payback period and ROI for your solar project.

- How to calculate the payback period and ROI for your solar project if you use a solar loan.

How is solar an investment?

A residential solar power system isn’t an investment like stocks or bonds— though it can provide some nice returns. It is closer to a home renovation. You’re renovating how your home gets most of its electricity. Instead of paying the utility company for electricity, you have something that can generate its own electricity.

But that equipment is expensive. So is the cost of installation. So, of course, the number one question we get asked is, “Is solar worth it?”

Let’s find out if Solar is worth it!

We’re going to use some classic investment math: Payback Period and Return on Investment (ROI).

Payback period: The amount of time it takes for you to recoup the initial investment. Often represented in months, but in solar it’s often measured in years. For example, if a company invests $100,000 in new equipment, and it saves them $25,000 a year in operating costs, then the payback period is 4 years. (100,000 / 25,000 = 4.)

Return on Investment (ROI): This is the net benefits divided by the initial investment. In most business situations, the ROI is represented as a percentage. However, in solar, we represent your ROI as cash savings just to make it easier to understand.

Expanding on the example above, if that new $100,000 equipment lasts for 20 years, then the return on investment is 400% or $400,000.

(25,000 x (20 – 4)) / 100,000

(25,000 x 16) / 100,000

400,000 / 100,000 = 4

4 x 100% = 400%

Woah, that’s a lot of math! Don’t worry, we’ll try to keep the numbers easy.

Let’s look at two financing scenarios. What is your payback period and ROI if you purchase a solar system with cash? And what is your payback period and ROI if you use a solar loan?

While these are hypotheticals, we’ll back them up with real-world examples of customer satisfaction.

The first step of any solar project is to figure out how much you’re paying for electricity right now.

The first thing we do, before we even draft up any solar designs, is figure out your average utility bill. That tells us how much energy your household consumes, which will decide how many solar panels you’ll need.

Let’s use some averages. According to EnergySage, the average home in Virginia Beach uses an average of 1,341 kWh per month. At the time of writing, Dominion Energy charges you 14¢ per kWh. However, that is most certainly going to increase in the future.

So the average monthly utility bill is $181. Remember, that’s an average. Of course, you most likely pay a much higher bill for January when it’s freezing than in May when it’s comfortable. Most of our household energy consumption comes from heating and air conditioning.

Solar empowers you to control your utility costs.

Unfortunately, utility companies pass the volatile price of fossil fuels and rising operational costs onto YOU.

“When I first moved here ten years ago, my electric budget was around $129. It’s gone up to $256,” explains Laura Kippes, a Hampton Roads resident and proud solar owner. She recognized that energy prices would only continue to rise, so she took control of her utility costs.

Since her solar installation, Laura has enjoyed remarkable savings. “These past two months, my bill has been $9.33,” she reveals. “I feel like solar has been very beneficial to me. I love the cost savings, especially. It’ll keep my bills from going up in the future, and I’m really happy.”

The next question is, how much energy do you want to supplement with solar energy?

This can range from as low as 65% to 103%. We typically stay around 90-95% for net metering purposes. Higher percentages may be more appropriate for those with a battery backup system.

To keep the math easy, let’s say you want to supplement 100% of your energy consumption.

65% may not sound like a lot, but it can make a HUGE difference!

Take it from one of our past clients, Juli Mosnes. She purchased a 6.48 kW system that supplements 65% of her family’s electricity consumption.

“Our expectations have not only been met but they’ve really been exceeded,” Juli says. “We were never expecting to see such low bills. We were thinking maybe $100 here or there saved, but to be able to say that we pretty much don’t have an electric bill because of these solar panels is just really impressive. We kind of chuckle about it all the time, but it’s really cool to see just how efficient they’re running and how much money that’s saving us in the long run.”

Over the next 30 years, Juli’s family is expected to save over $110,00! Listen to Juli tell her story here.

Finally, let’s calculate your solar system’s size or how many panels you will need.

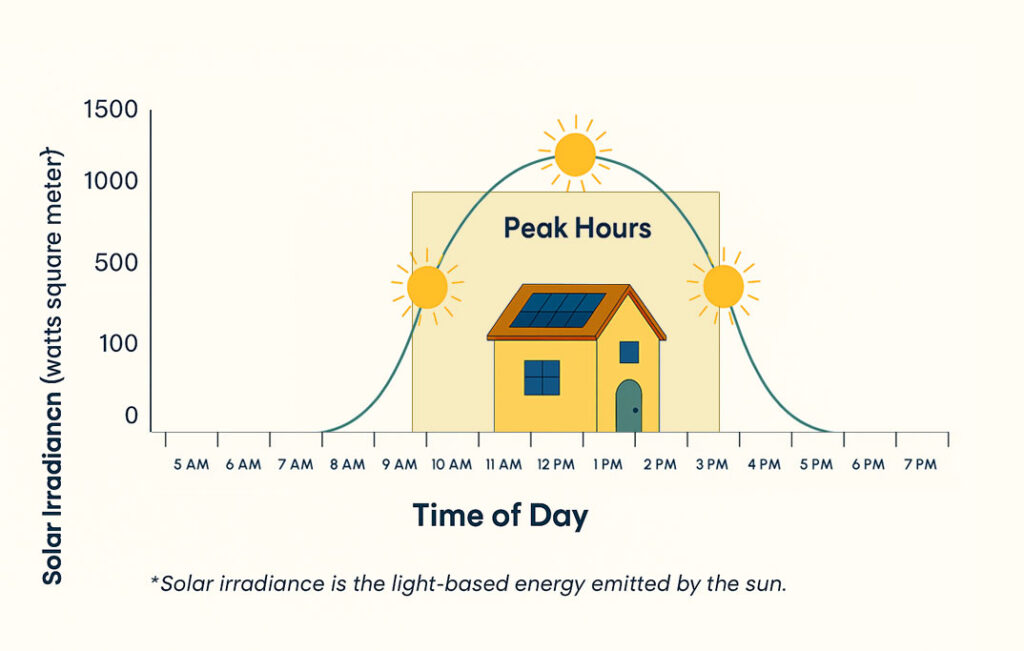

To do so, we’ll need to understand peak sunlight hours. Peak sunlight hours represent the brightest the sun is during the day. Solar panels provide their maximum output during these peak sunlight hours.

Regions closer to the equator will get more peak sunlight hours. While regions further from the equator received less. For example, Texas gets around 4 peak sunlight hours in the winter and up to 7.5 in the summer. Virginia gets an average of 4 peak sunlight hours for the entire year.

So, let’s figure out how much energy you consume every day. Let’s divide the average monthly energy consumption by 30, which is the average number of days in a month. We get 44.7 kWh per day (1,341 kWh / 30 days = 44.7).

Next, we divide that by how many sunlight hours our region receives. So 44.7 divided by 4 equals 11.175. That’s our system size: 11.2 kilowatts.

Then we divide that by the wattage of our panels, which is 400 watts or 0.4 kilowatts, to get 28 panels.

Let’s calculate how much an 11.2 kW solar system costs.

This is easy. All we have to do is multiply our system size by the cost-per-watt rate. The national average rate to install solar in the United States is $3.02 per watt. In Virginia, our average is $2.80 per watt.

11,200 x 2.80 = $31,360

To summarize our system, we have an 11.2 kW system that supplements 100% of our energy consumption, costing $31,360.

That was a lot of math! But by using those formulas, you can now calculate the size and cost of your solar system.

What about the 30% federal solar tax credit, sometimes called the ITC?

Whether you buy your entire system outright or use a solar loan, you are entitled to the 30% federal tax credit. As long as you purchase a system, not lease or rent, you’re entitled to the ITC.

The solar tax credit is a federal program that incentivizes solar projects. It’s a reduction on the taxes you owe equal to 30% of the net cost of installation.

Let’s say your solar system has a net cost of $30,000. Tax season rolls around, and you owe $15,000. You apply your solar tax credit of $9,000 (30,000 x 0.3), reducing the amount you owe to $6,000. If you owe less than your tax credit, you can roll it over for up to five years.

Scenario 1: Buying your entire Solar system outright.

Using the groundwork we laid above, let’s determine the payback period and ROI. Remember, the payback period is just the amount of time it takes for you to recoup the initial investment.

The net cost for our 11.2 kW system is $31,360. But it’s entitled to the ITC. So the initial investment is $21,952. ($31,360 x 0.30 = $9,408)

That system saves you $181 a month. So divide the initial investment by the monthly savings to calculate how many months it will take to pay back.

The payback period equals $21,952 / $181 = 121.3 months or a little over 10 years.

Next, let’s figure out the ROI

ROI equals net benefits divided by the initial investment. So, let’s figure out the net benefits. How much savings will we earn over the complete lifespan of our solar system? The industry standard warranty for solar panels is 25 years. However, most continue to function (albeit at a lower efficiency) for much longer. So we at Convert Solar use 30 years instead.

So let’s multiply our annual savings by 30 years to determine our net benefits.

($181 x 12) x 30 = Net Benefits

$2,172 x 30 = $65,160

We can subtract our initial investment to get lifetime savings. Or divide our net benefits by the initial investment to get ROI as a percentage.

$65,160 – $21,952 = $43,208

($65,160 / $21,952) x 100% = 297%

Scenario 2: Using a Solar Loan.

If we all had $30,000 available, we’d probably all take a well-deserved vacation. But the vast majority of us don’t. Luckily, there are solar loans, specialized loans designed to make solar more affordable. We even offer various financing options, such as a $0 down, $0 out-of-pocket solar loan.

Solar loans change the payback period and ROI equations by replacing the initial investment with total out-of-pocket costs.

Let’s say you get a loan for the initial investment, $21,952. Remember, you are still eligible for the ITC. Our financing department will even help you by providing all the tax incentive information to your tax preparer.

You take out a loan of $21,952 at 6% interest and will pay it back over the next 10 years. Using a loan calculator, we’ll figure out all the details.

Monthly Payment: $243.71

Total out-of-pocket costs: $29,245.46

Total interest: $7,293.46

Let’s divide the total out-of-pocket costs by the monthly savings to calculate how many months it will take to pay back.

$29,245 / $181 = 161.6 months or around 13 and a half years.

Now for the ROI of a solar loan

ROI equals net benefits divided by total out-of-pocket costs. We already figured out the net benefit ($65,160).

$65,160 – $29,245 = $35,915

($65,160 / $29,245) x 100% = 223%

Those are only the financial benefits. You can’t put a price on a brighter future!

“The peace of mind we get in the summer, when you use a lot of electricity, is incredible. We always know that our electric bill won’t be too high,” notes John Harrison, another solar success story. “If you can afford it, do it.”